America’s Federal Reserve raised its benchmark interest rate by one-quarter of a percentage point, to a range between 4.5% and 4.75%, following six consecutive larger increases. Jerome Powell, chair of the central bank, promised “a couple more” rate increases and warned not to expect rate cuts this year. The Fed is keen to impress upon investors that it will do whatever it takes to squelch inflation.

Meta’s share price rocketed by almost a fifth in post-session trading after it reported quarterly revenues of $32.2bn, down by 4% year over year but above forecasts. The social-media firm also said it would buy back $40bn-worth of its shares. Earlier a judge in California reportedly ruled that Meta can proceed with its acquisition of Within Unlimited, a virtual-reality firm. The Federal Trade Commission had requested an injunction to block the deal.

Adani Enterprises, flagship of the Adani Group’s listed companies, called off its fully subscribed $2.4bn share sale. The company said the decision was taken to “insulate [investors] from any potential financial losses”. Shares in the vast Indian conglomerate fell by 28% on Wednesday. Adani Group has now lost $92bn in market value since Hindenburg Research, a short-seller, said the business empire was a giant con.

Ukraine’s security services raided the house of Ihor Kolomoisky, a billionaire and former patron of President Volodymyr Zelensky as part of an anti-corruption campaign. Security forces also targeted the home of Arsen Avakov, a former interior minister. Mr Avakov said he was raided as part of an investigation into his buying of helicopters–one of which crashed and killed his successor–while in government.

Rivian said it would lay off 6% of its staff of 14,000 amid a coming electric-vehicle price war. Tesla and Ford recently announced price cuts for their electric cars. Rivian, which makes electric trucks, lost $5bn in the first nine months of last year. Its share price has plunged by 90% since a wildly successful flotation in 2021.

The pace of euro-zone inflation slowed to an annual rate of 8.5% in January, according to preliminary figures, the third monthly decrease in a row. Lower energy costs are largely responsible for the deceleration. But core inflation, which excludes volatile energy and food prices, remains at an all-time high. European central bankers are expected to hike interest rates again on Thursday.

The largest day of industrial action in at least ten years began in Britain as teachers, civil servants, train drivers, and university lecturers walked out over pay and working conditions. Around 500,000 workers are expected to participate. Britain’s government warned of “significant disruption”, with thousands of schools closed. Healthworkers and firefighters are planning more strikes soon.

Fact of the day: 100,000, the number of Russian exiles who have taken refuge in Georgia. Read the full story.

The Adani empire under threat

What next for the Adani Group? On Wednesday the flagship company of the Indian conglomerate cancelled a secondary share offering, which had been fully subscribed, after its share price plunged. The rout started last week when Hindenburg Research, an American short-seller, accused the Adani Group of accounting fraud and share-price manipulation—charges that it forcefully denies.

The threat does not appear existential. Gautam Adani, the founder and until recently the world’s third-richest man, is considered an able operator and his companies own many valuable assets. No rating agency has yet reappraised the group’s debt, which boasts an investment grade.

Yet it is hard to believe that Mr Adani’s grand investment plans will be unaffected. Between 2023 and 2027 his group was forecast to spend more than $50bn on investments. If the yields on Adani bonds remain elevated and its share prices depressed, securing the necessary funds will prove difficult. Foreign investors are not taking any chances. In just two recent days, global funds pulled a net $1.5bn from the Indian stockmarket.

Sweden and Finland discuss NATO bids

When Sweden’s prime minister, Ulf Kristersson, welcomes his Finnish counterpart, Sanna Marin, to Stockholm on Thursday, he will be looking for a show of solidarity. After Russia invaded Ukraine the Nordic neighbours decided to give up their long-standing non-aligned status, and applied to join NATO. But they were blocked by Turkey, which like all NATO members has a veto. Turkey extracted promises from both countries to crack down on residents associated with the Kurdistan Workers’ Party (PKK), a violent separatist group in Turkey.

Now Turkey has new demands. Last month, for reasons unknown, a far-right Danish politician burnt a Koran outside Denmark’s embassy in Stockholm. The act prompted protests across the Muslim world. Turkey’s president, Recep Tayyip Erdogan, says he is ready to approve Finland’s NATO application, but that Sweden must outlaw Koran-burning before it can join. Mr Kristersson has condemned the act, but says his country’s laws on freedom of expression are non-negotiable. Ms Marin will no doubt pledge to stand by her Swedish friends.

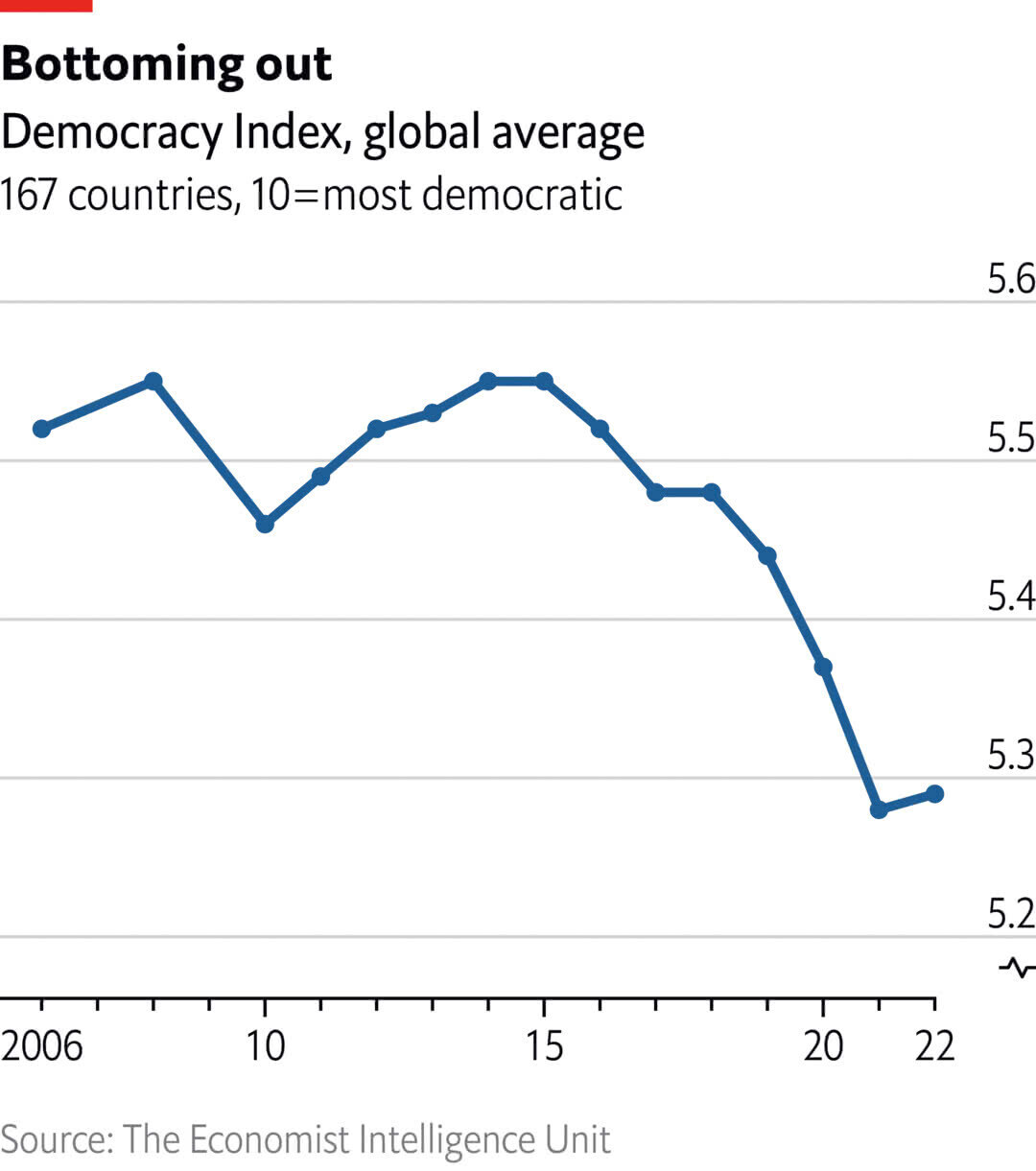

The steady retreat of democracy that began in 2016 at last came to an end in 2022. Yet a hoped-for revival did not materialise. According to the Democracy Index, an annual snapshot published by The Economist’s sister company, EIU, the average score among 167 countries ticked up by just 0.01 points, to 5.29 out of 10. More than a third of people worldwide still live under authoritarian rule and less than half live in a democracy.

The lifting of pandemic-related restrictions almost everywhere last year—China was a notable exception until December—improved scores in the “civil liberties” category. But any gains were wiped out by democratic backsliding elsewhere. A bungled attempt by the now-ousted president of Peru to shut down Congress resulted in the country’s being downgraded to a “hybrid regime”. Burkina Faso suffered not one but two coups. But it was Russia that recorded the biggest democratic decline of any country in the world, falling 22 places to 146th.

The BoE’s interest-rate decision

The Bank of England is expected to raise its interest rate to 4% on Thursday, from 3.5%. The key question, though, is what signal the central bank’s nine-member monetary-policy committee will send about the pace of future rises. In November it noted that market expectations of where rates would peak were higher than its own. Market interest rates have since come down.

The committee may be more uncertain than usual about prospects for inflation, and thus interest rates. The bank’s governor, Andrew Bailey, has suggested that falling wholesale gas prices will make it easier to reduce inflation without steep increases in rates, which would be good news for the economy. But the bank’s chief economist, Huw Pill, has warned that Britain faces a unique combination of challenges that could cause inflation to persist more stubbornly than in America or Europe. If so, interest rates may have to continue rising more quickly and steeply than some observers expect.

Why China chooses to forget

Zhang Hongbing’s mother was executed in 1970 after being branded a counter-revolutionary. Such horrors were not uncommon during the Cultural Revolution, a decade of Maoist madness that began in 1966 and saw up to 2m people killed for supposed political transgressions. But the case of Mr Zhang’s mother stands out, because he and his father had been her accusers.

Mr Zhang’s memory of the event seems strange to Tania Branigan, the author of “Red Memory”. He existed in it “as a Maoist algorithm: inputs, rules, outputs”, she writes. How people remember the Cultural Revolution—or why they have forgotten it—is the theme of her penetrating book.

China’s leader, Xi Jinping, has suppressed discussion of the Cultural Revolution. He has accumulated more power than any leader since Mao Zedong and created his own cult of personality. “What makes the era’s lessons so vital is also what makes them impermissible,” writes Ms Branigan.

'The World in Brief - with vocab.' 카테고리의 다른 글

| Update at 13:11 GMT, Feb 4, 2023 (0) | 2023.02.04 |

|---|---|

| 2월 2일 업데이트: squelch부터 impermissible까지 (0) | 2023.02.02 |

| 1월 31일 업데이트: ruled out부터 propping up까지 (0) | 2023.01.31 |

| Update at 13:40 GMT, Jan 31, 2023 (0) | 2023.01.31 |

| 1월 30일 업데이트: ballots부터 anti-Semitic까지 (0) | 2023.01.31 |